Some U.S. states have agreements that benefit people who work across state lines.

Jump to:

| What is a reciprocal agreement between states? |

| Which states have reciprocal agreements? |

| Bilateral vs. unilateral agreements |

| Do state reciprocity agreements apply to remote workers? |

| How to manage state and local tax |

Do you have clients who live in one state but work in another state? If so, they may be able to lower income taxes through a state-by-state reciprocity agreement, should the agreement exist.

The COVID-19 pandemic resulted in more people working from home, with some people relocating to a different state to work remotely. According to the most recent U.S. Census Bureau data , 2.9% of people (4.5 million) worked outside their state of residence as of 2021.

Meanwhile, the data also showed that the number of people primarily working from home tripled from 5.7% (roughly 9 million people) to 17.9% (27.6 million people) between 2019 and 2021.

However, the rise of hybrid work environments , where people may work in the office some days and work remotely from home other days, can further complicate tax filing for individuals who commute across state lines.

Therefore, it is important that accounting professionals are familiar with reciprocity states to simplify filing and reduce the tax burden for those commuting workers who can benefit from reciprocal agreements.

State reciprocity agreements are pacts between two or more states that allow residents to only pay income tax on where they live versus where they work. In other words, if your client travels across a state line to work, they pay income taxes only to their state of residence, if those states have a reciprocal agreement.

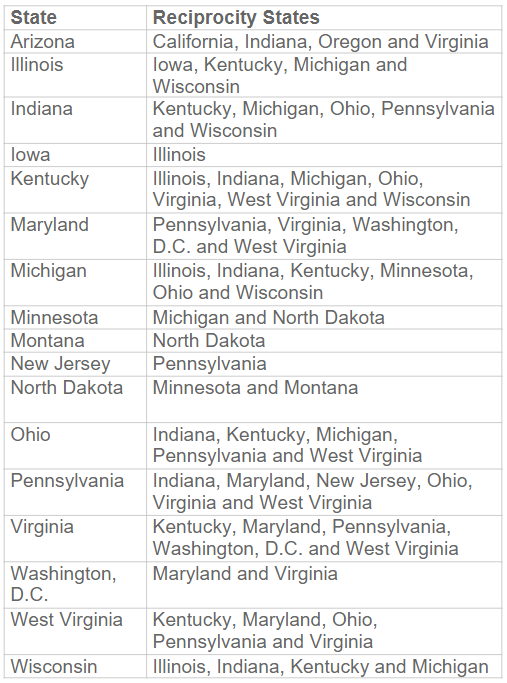

There are currently reciprocal agreements across 16 states and the District of Columbia.

Let’s say a client lives in Maryland but works in Pennsylvania. They would not have to pay state taxes in Pennsylvania because those two states have a tax reciprocity agreement. In Pennsylvania, Form REV-419 is the Employee’s Nonwitholding Application Certificate.

As noted above, there are reciprocal agreements across 16 states and the District of Columbia. The following chart outlines those states that have reciprocal agreements:

Bilateral vs. unilateral agreements

It is important to be aware that not all state reciprocity agreements are created equal. There are two kinds of agreements: bilateral and unilateral.

Seventeen of the 30 existing reciprocal agreements are bilateral agreements . In these cases, statutes may dictate which sources of income are subject to the agreement. It could also be left to the discretion of revenue officers to conform to the policy of the reciprocating state.

For example, Montana only enters such agreements with contiguous states, as outlined in Montana’s law.

There are three states — Wisconsin , Minnesota, and Indiana — that will automatically extend reciprocity to any state that provides similar treatment to their own residents. There are, however, certain rules and conditions to consider.

An illustration of the unilateral agreement can be found in Indiana’s law , which can be summarized as: Nonresidents of Indiana who earn income within the state are exempt from taxes imposed by Indiana if the state or territory they are a resident of has a reciprocal provision which exempts residents of Indiana from taxes when they earn income within the state.

The short answer is “yes,” if there’s a reciprocity agreement between the states in which an employee lives and works.

As stated earlier, the rise in remote work environments, where people may work in the office some days and work remotely from home other days, can have tax-related consequences for individuals who commute across state lines.

The challenges stem largely from the various forms of state reciprocity agreements. Not all agreements are created equal. For example, states can vary in how many days a nonresident employee can work in a nonresident state before withholding is mandated. And Maryland and Virginia, for instance, have a commuter provision in place that reciprocally exempts nonresident commuters from income tax (this is on top of the fact that both states also have bilateral agreements with multiple states). These are just a few examples of the complexity that can arise.

It should also be noted that if an employee is living and working between states that do not have a reciprocity agreement in place, they may be eligible for a credit for taxes paid to other states. This is to avoid double taxation. However, to get the credit, they may need to file in multiple states. Plus, their out-of-state tax burden may be only reduced — not eliminated.

The bottom line is that there are several factors that must be considered for clients working remotely.

Navigating the nuances of state-by-state reciprocity agreements can be complex without the right tools and resources in place.

Be confident in your firm’s ability to effectively conduct multi-state tax research with Thomson Reuters Checkpoint Edge ® . This robust solution features state comparison charts and one-click access to local state tax reports.